Ohio Capital Gains Tax Rate 2025. 4 tax planning ideas to reduce ohio capital gains taxes. In this video, we're going to talk about what capital gains taxes are and we'll dig into the basics of ohio capital gains taxes.

What is the ohio capital gains tax? Last updated on april 23, 2024.

While The Federal Government Taxes Capital Gains At A Lower Rate Than Regular Personal Income, States Usually Tax Capital Gains At The Same Rates As Regular Income.

This means that if your capital gains exceed these thresholds, you are required to report and pay taxes.

Some Of The Bill's Highlights Are As Follows:

Last updated on april 23, 2024.

Ohio Capital Gains Tax Rate 2025 Images References :

Source: jessamynwdynah.pages.dev

Source: jessamynwdynah.pages.dev

Ohio Capital Gains Tax Rate 2024 Pen Leanor, We've got all the 2023 and 2024 capital gains. Confused about the federal income tax rates on capital gains and dividends under the tax cuts and jobs act (tcja)?

Source: curchods.com

Source: curchods.com

How Capital Gains Tax Changes Will Hit Investors In The Pocket, The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held. The combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on capital gains and the marginal effect of pease limitations (which results in a tax rate increase.

Source: thenewsintel.com

Source: thenewsintel.com

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, The table below summarizes uppermost. Investors and taxpayers are hoping for a reduction in the capital gains tax.

Source: wsbets.win

Source: wsbets.win

13 states would have a top combined capital gains tax rate at or above, Depending on the holding period of one to three years, capital gains. This tool is freely available and is designed to help you accurately estimate your 2025 tax return.

Source: howmuch.net

Source: howmuch.net

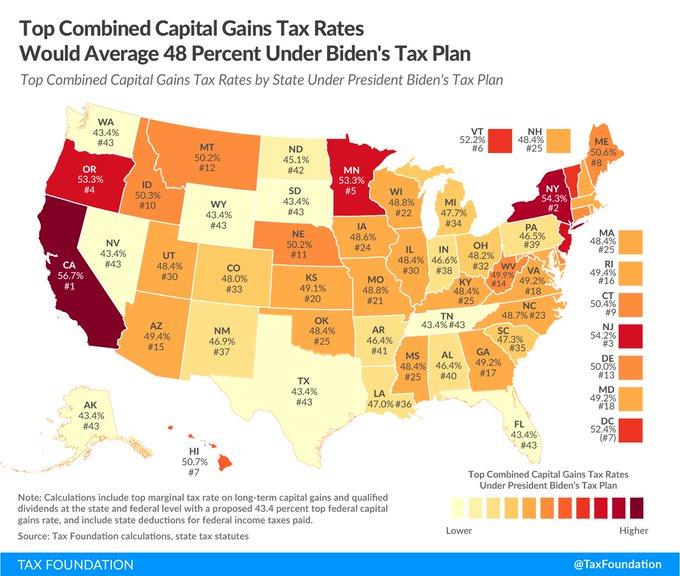

Mapped Biden’s Capital Gain Tax Increase Proposal by State, The 2024 tax rates and thresholds for both the ohio state tax tables and federal tax tables are comprehensively integrated into the ohio tax calculator for 2024. Here's a break down of the changes between the old and new rules that you need to know.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QHPDX5S74VCJFAU6Q2VGZK5OFU.png) Source: www.morningstar.com

Source: www.morningstar.com

What You Need to Know About Capital Gains Distributions Morningstar, We've got all the 2023 and 2024 capital gains. Explore potential deductions, credits and confidently file the tax return.

Source: www.hitaxfairness.org

Source: www.hitaxfairness.org

Capital Gains Tax Reform — HI Tax Fairness, What is the ohio capital gains tax? This means that if your capital gains exceed these thresholds, you are required to report and pay taxes.

Source: your-projector-site.blogspot.com

Source: your-projector-site.blogspot.com

new capital gains tax plan Lupe Mcintire, Capital gains tax rate 2024. Investors and taxpayers are hoping for a reduction in the capital gains tax.

Source: www.makeoverarena.com

Source: www.makeoverarena.com

Capital Gain Tax Rate How to calculate Capital Gain Tax Rate, The following are the ohio individual income tax brackets for 2005 through 2023. Explore potential deductions, credits and confidently file the tax return.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

What is the effect of a lower tax rate for capital gains? Tax Policy, Capital gains tax is applicable on the profit arising from the selling of any movable or immovable asset. Depending on the holding period of one to three years, capital gains.

The 2024 Tax Rates And Thresholds For Both The Ohio State Tax Tables And Federal Tax Tables Are Comprehensively Integrated Into The Ohio Tax Calculator For 2024.

Ohio capital gains tax in 2024 explained.

While The Federal Government Taxes Capital Gains At A Lower Rate Than Regular Personal Income, States Usually Tax Capital Gains At The Same Rates As Regular Income.

We’ve got all the 2023 and 2024 capital gains.

Category: 2025