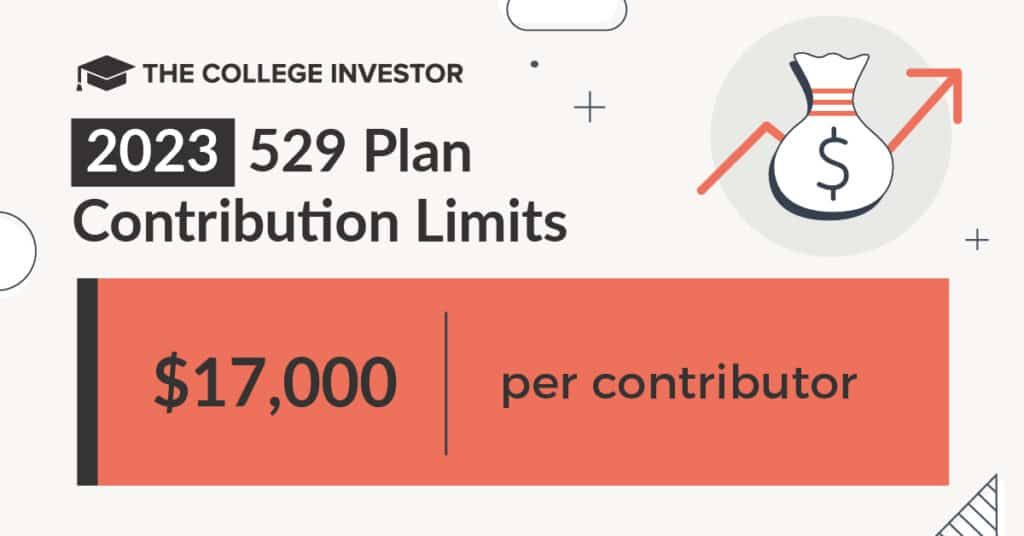

Max Contribution For 529 2024. In 2024, you can give up to $18,000 per person without impacting your lifetime gift tax exemption. This means all earnings in your account are reinvested, not depleted by taxes.

Annual contributions over $18,000 must be reported to the irs. Instead, the amount you can contribute is maxed out at a total contribution for a single beneficiary, depending on what plan you invest in.

Max Contribution For 529 2024 Images References :

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: nyssablucinda.pages.dev

Source: nyssablucinda.pages.dev

Max 529 Contribution 2024 Wisconsin Lydie Romonda, For married couples filing jointly, the limit is $36,000.

Source: elseylaurie.pages.dev

Source: elseylaurie.pages.dev

Maximum Annual 529 Contribution 2024 Valry Virgie, 529 plans do not have an annual contribution limit.

Source: bobbibrozanne.pages.dev

Source: bobbibrozanne.pages.dev

Maximum Contribution To 529 Plan 2024 Gerri Cornelia, The limit is $35,000, as long as the 529 account has been open for at least 15 years.

Source: cassblethia.pages.dev

Source: cassblethia.pages.dev

Maximum Annual 529 Contribution 2024 In India Emalee Halette, The maximum contribution limit pertains to each beneficiary.

Source: mercyqbenedetta.pages.dev

Source: mercyqbenedetta.pages.dev

Maximum 529 Plan Contribution 2024 Noemi Angeline, Each state’s plan has different 529 contribution limits and tax benefits for its residents.

Source: daffieqsamara.pages.dev

Source: daffieqsamara.pages.dev

Edvest 2024 Contribution Limits Laura, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

Source: elsieqgianina.pages.dev

Source: elsieqgianina.pages.dev

Iowa 529 Contribution Limit 2024 Zora Annabel, The limit is $35,000, as long as the 529 account has been open for at least 15 years.

Source: nyssablucinda.pages.dev

Source: nyssablucinda.pages.dev

Max 529 Contribution 2024 Wisconsin Lydie Romonda, In 2024, you can give up to $18,000 per person without impacting your lifetime gift tax exemption.

Source: tobiqcissiee.pages.dev

Source: tobiqcissiee.pages.dev

Nys 529 Max Contribution 2024 Coreen Tuesday, The total cap ranges from $235,000 to $530,000 in 2024.

Source: wilhelminewraf.pages.dev

Source: wilhelminewraf.pages.dev

What Is The Maximum 529 Contribution For 2024 Adena Arabela, 529 contribution limits are affected by education costs as well as federal gift tax laws.